An economist in 1798 theorized that a population and culture wold continue to grow until stopped by war, famine or revolution. Well, we got two out of the three.

When I look at just the famine piece and put the systematic deep racism aside for a moment. That seems to be all about income inequality. That’s hardly a hot take. It still baffles me that no Democratic platform has an answer for how to fix it. Better taxes helps a little bit as does universal healthcare but that still doesn’t make it possible for an Amazon delivery driver to buy a home and join the middle class.

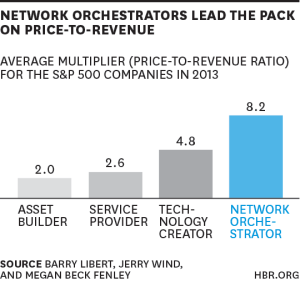

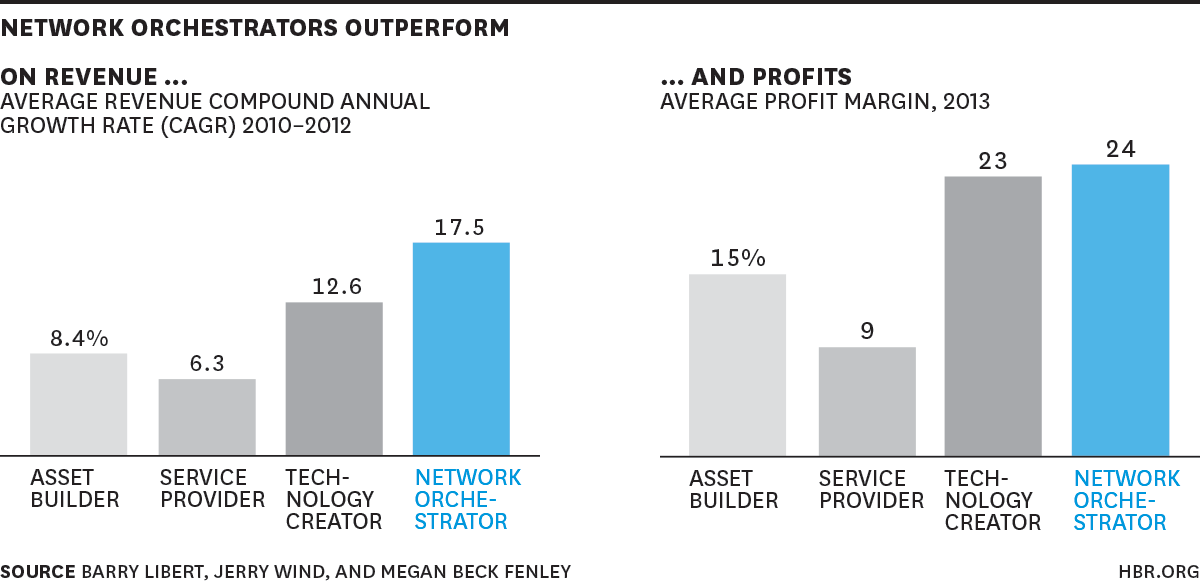

When I look at why we are where we are, the inequality has been drastically escalated over the past 60 days. All the businesses that have failed are local and retail, and all the ones that are succeeding are upper class tech jobs. Shit, Amazon went from 18% of the retail market to 28% in 60 days. It was previously growing 1% a year. That can’t be good for the middle and lower class.

America doesn’t work for half the country and we need to figure out a ways for it to do so. I‘m open to ideas but think a good start would be a $20 minimum wage. That seems logical. Can someone tell me why we shouldn’t do that? Continue reading “80: War, Famine, or Revolution”