An employee recently left Kapost (sad to see you go T) and i was out to lunch with her and she asked some advice. I thought back to two pieces of advice that I was given or things that i have witnessed from successful colleagues. Here’s what popped up:

“90% of Power is Taken not Given”

This is a quote from my old boss Bill Raduchel. Bill loves saying phrases like this to me, and this was one juicy nugget he spat out in 2002 when I was working at AOL. I took it to heart. I was a product manager at the time and aspired t

o have even more responsibility within the company. He noticed that and delivered this great quote. What he meant was that nobody is going to give me extra responsibility. If i want it, i have to go take it and earn it.

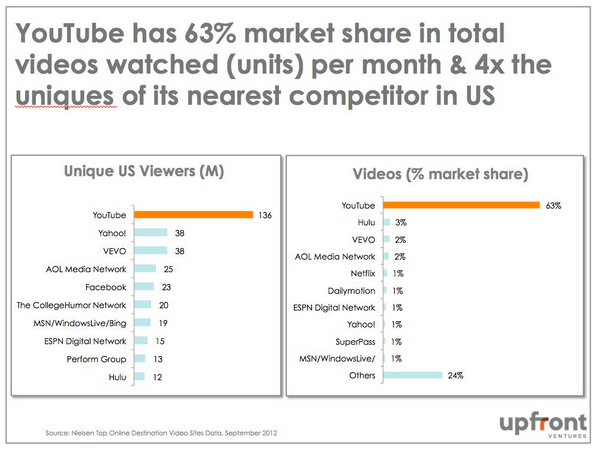

That’s what i did. I wanted to run video services within the company. There were lots of people running bits and pieces but nobody was owning it. Instead of waiting for a title and position to be created, i just started acting like i was the defacto video product manager. I had weekly all-hands meetings with the other stakeholders, came up with a product roadmap, and basically acted like the product owner. What happened? Eventually the company realized i was the product owner and rewarded me with that title.

In small companies there are too many things to do. In big companies there are lots of ambiguity, swirl and gray space. In both instances, there’s an opportunity to do what you want. Just be proactive and go do it. In real estate, ownership is 9/10 the law. In startups, doing is 9/10 the position.

Don’t Eat Alone

This is just something i’ve realized. Most of the people we hire at Kapost come from referrals. Most of the opportunities i’ve been given in my career come from contacts of friends of friends. The size and strength (i.e. authenticity) of your network matters in today’s work world and in your career. I’ve seen people (Nick O’Neil) go crazy about this where they actually track in a spreadsheet the people they’ve met and want to keep in touch with and make sure every X number of days that they give them an update. It may sound excessive but it works. He has a ton of connections who regularly help him out.

There’s even a pretty good book, called “Never Eat Alone” which talks about the power of these connections.

Those are two things that immediately came to mind. I’d be curious if any of you have heard any other nuggets of great advice that you’d like to share.